Personal banking is a complicated subject that can be hard to understand. But if we use what we’ve learned from behavioral economics, we can learn more about how we make financial choices and improve our overall financial health. In this blog, we will talk about the role of behavioral economics in personal finance. We will look at the cognitive errors and psychological factors that affect our financial decisions.

By understanding these patterns of behavior and using practical strategies, we can make better choices, form better money habits, and, in the end, become financially stable and successful. Come with us as we explore the interesting world of behavioral economics and how it affects our own money.

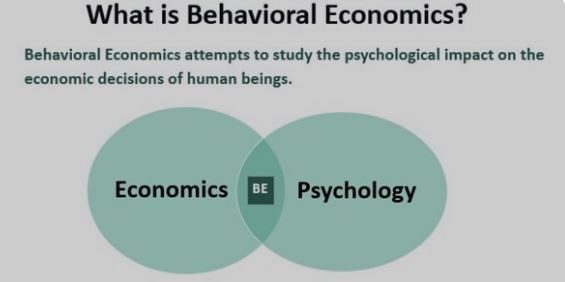

What is Behavior Economics?

Behavioral economics is the study of how people and organizations make economic decisions based on their emotions. Most of the time, ethical economics and behavioral economics go together. It uses psychology and economics to investigate why people make illogical judgments and why and how their behavior does not match economic model predictions.

Understanding Behavioral Economics

In 2017, when Richard Thaler, a professor at the University of Chicago, won the Nobel Prize in Economics, behavioral economics became a popular term. The idea is easy to understand: buying is not just a matter of numbers. Psychology plays a part in how people and institutions make economic decisions. If you know how people think, you’re ahead of the game when it comes to making money choices.

Behavioral economics tries to explain why people sometimes make bad choices when it comes to money and why their actions don’t always match what economic models say they will do. Behavioral economics helps people decide things like what kind of car to buy, how much to save for retirement, and whether or not to eat that last piece of chocolate cake. Behavioral economics tries to figure out why people choose one thing over another. Because people can be emotional and easily distracted, they sometimes make choices that aren’t in their best interest.

There are some simple ways that you can use behavioral economics in your daily life. Here are just a few.

Availability Bias

The availability bias says that our decisions are most affected by things that are close to us and easy to find. After a big storm, you are more likely to buy a snow shovel than in the middle of summer.

How does this relate to making money? “FOMO,” which stands for “fear of missing out,” is a result of availability bias. You may think the price of a stock is too high, but the price keeps going up. If you don’t buy this stock at $500 per share, you might be worried that it will be $1,000 next year.

Anchoring

Anchoring is something that can cause bad effects when you’re investing. Let’s say you find a stock that used to sell for $100 per share but now costs $80. If you got that stock for $100, you might be hesitant to sell it for $80, $90, or $95, because you paid $100 for it. This has nothing to do with how much the business is worth.

Be aware that corporate America knows this and is using this type of economics to market its goods. Anchoring is something that tech companies use all the time. This is often the case when a new smartphone comes out. Let’s say the new phone cost $800 when it first came out but now sells for $500. By selling the phone at a higher price at first and then lowering it, people will think they are getting a good deal, even if the plan was to sell the phone for $500 from the start.

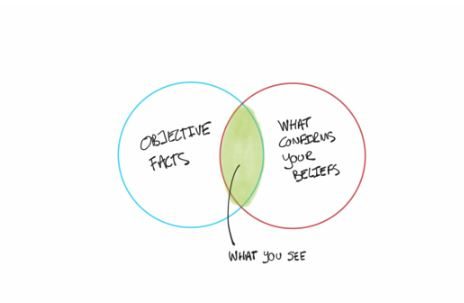

Confirmation Bias

Confirmation bias is when we pay more attention to things that back up what we already think. We usually come up with reasons for why we believe what we do and pay less attention to things that go against what we believe. Almost everyone does it, and it can be risky when we’re spending. If you like the goods a company makes, you might not pay attention to any warning signs or risks the company is having.

The Gambler’s Fallacy

What would happen if you bet on a coin toss and “heads” came up five times in a row? The gambler’s fallacy says that you should bet on “tails” because you know that getting “heads” six times in a row is impossible. But in reality, the chances are always 50/50. The first five flips have nothing to do with the sixth one.

When we spend, the same thing happens. When a stock has gone up or down for several days or weeks in a row, people often make the gambler’s error mistake. This can make you buy low and sell low, which is bad.

Herd Behavior

You can see herd behavior in many places. When people wait in line for tacos at a food truck, other people usually join them. The idea is that if there is an extensive food line, it must be good. Even in trading, people sometimes act like a herd. When everyone buys a stock, there is a hidden idea that it can’t go wrong because everyone is buying it. Exuberance, overvaluation, and price spikes can happen when people act like everyone else.

Bias and Automatic Enrollment

Present bias is an excellent way to explain why most people are bad at saving money. In a trade-off situation, it’s just the desire to take a smaller reward now instead of waiting for a bigger reward later.

In the past few years, people have changed at least one thing about how they save money because they understand current bias. It’s the most common way that companies use “auto-enrollment” in their pension plans.

Because of the work of behavioral scientists like Richard Thaler, auto registration was made possible. And that study showed that you were less likely to do something, like use a 401(k) to save money, if you had to do something to join in.

Studies by Allianz Global Investors and others have shown that saving goes up when a company switches from an “opt-in” retirement plan, in which the employee has to choose to join, to an “automatic enrollment” plan, in which the employee doesn’t have to do anything. So, the idea of auto-enrollment was born, and in 2006, it became part of the Pension Protection Act.

Automatic enrollment is a feature of the Pension Protection Act that lets an employer sign up for its employees and cut their pay without going through the real enrollment process. It’s just easier to join now, and as a result, more people are saving money.

Conclusion

Behavioral economics shows how people often make bad choices because of biases they may not even realize they have. When we least expect it, our biases can affect our choices, even financial ones. They can make it hard to think straight and make us come to bad conclusions. I hope today’s blog made you more aware of these biases so you can keep them in mind when making important financial choices and developing ways to protect yourself.

Editor’s Choice:

Debt Management for Doctors: Navigating Medical School Loans & Financial Goals

Retirement Planning for Doctors to Build a Financially Secure Future

Leave a Reply

Want to join the discussion?Feel free to contribute!